Sales tax in the US is as messy as the drawer of a five-year-old. With states, cities, and counties charging taxes that vary across products and even ingredients, it can get complicated—something your average bookkeeper wouldn’t touch with a 10-foot pole.

This is where ecommerce sales tax software comes into play. These tools automate the process of sales tax calculation, collection, and remittance, making it easier for businesses to stay compliant and focus on their core operations.

Sales tax tools you might want to consider for your ecommerce store

If you search the web, you’ll find hundreds of tools that claim to help you with sales tax compliance. But most fail. That’s why I did my research to find these five tools that take the prize. Take a look and let me know what you think.

1. Numeral

Numeral simplifies this process by offering a comprehensive solution that runs your store’s sales tax on autopilot.

A YC-backed company, Numeral is designed to fully manage the complexities of sales tax, allowing businesses to focus on their core operations. It’s backed by marquee investors like Shaan Puri, Nik Sharma, and Moiz Ali and used by top-notch direct-to-consumer (DTC) brands like Obvi, Muddy Bites, and Immi Eats.

Key Features and Benefits

- Automated sales tax management: One of the standout features of Numeral is its ability to automate sales tax management. The software automatically monitors your store settings to ensure proper sales data collection. It also covers registering your business in all states it has nexus, eliminating the need for you to make a single phone call.

- Done-for-you of tax mail handling: When you register your business in a state, you receive government mail. About seven out of ten of these mail aren’t important. However, the ones with tax status updates or policy changes are. Missing these can cost you heavy penalties. With Numeral, all your tax mail is collected in a virtual mailbox—they receive, read and proactively reply to such mail seamlessly.

- 24/7 sales monitoring: Numeral provides 24/7 sales monitoring, an important feature for businesses operating round the clock. The software notifies you when you reach the economic nexus, keeping you updated on your tax obligations.

- Automated remittances: It takes the stress out of tax remittances by automating monthly, quarterly, and annual remittances on your behalf. This feature ensures that your business stays compliant without you having to worry about missing any tax deadlines.

- Comprehensive solution: Numeral offers a comprehensive solution for sales tax. From registration to remittance, it automates all aspects of sales tax for your store. This means you can focus on growing your business while Numeral pays your sales tax obligations.

- Integration with ecommerce platforms: It integrates with the best in ecommerce, acting as a bridge between platforms and your sales tax. This seamless integration ensures that your sales data is accurately captured and used for tax calculations.

- Top-notch customer service: Numeral offers 24/7 live chat support, ensuring help is always a chat away. You can access a registered Certified Public Accountant for quick and accurate replies. Numeral also provides strategic tax advice and communicates with state agencies on your behalf.

Pricing

Numeral operates on a flat fee structure with no subscriptions.

- They charge $75 per filing for each state, regardless of revenue. This includes state availability, payment remittances, continuous support, and audit documentation.

- For state registrations, they charge a one-time fee of $150 per state. This includes registration for all states, quick turnaround, free nexus audits, and monitoring of potential nexus.

And on the plus side, unlike other tools in the list, Numeral never makes annual contracts that tie you up.

Testimonials

Numeral has many positive testimonials from its users.

Alan Li, Founder of Green Philosophy Co, says, “If you’re looking for a comprehensive, user-friendly tax software service that will make filing your taxes a breeze, look no further. Numeral is quick and budget-friendly. I can’t recommend them enough to my fellow business owners!”

Ann Hang, Founder of Fling Wellness, says, “When running a D2C business, sales tax is the last thing I want to consider. The team at Numeral made onboarding a breeze. Their reporting gives me confidence that my filings are accurate and timely. Thank you, Numeral!”

2. TaxJar

TaxJar is a cloud-based platform that automates sales tax compliance for over 20,000 businesses. It simplifies the entire sales tax life cycle across all sales channels, from calculations and nexus tracking to reporting and filing.

Key Features and Benefits

- Sales tax automation: TaxJar automates your sales tax calculations, reporting, and filings in minutes, eliminating the need for manual work. It integrates with your existing platforms and automatically determines the sales tax due for each transaction based on the latest tax rules and rates.

- Nexus tracking: Its Nexus tracking feature helps you determine where you have a sales tax obligation. It tracks your sales and transactions in each state and alerts you when nearing a nexus threshold.

- Multi-channel support: It supports multiple sales channels, allowing you to manage your sales tax across all your platforms from a single dashboard. It integrates with popular ecommerce platforms and marketplaces like Amazon, eBay, Shopify, and more.

- Reporting and filing: TaxJar provides comprehensive reports that break down your sales tax collected by jurisdiction, product type, and more. It also automates your sales tax filings, submitting them on your behalf when they’re due.

Pricing

TaxJar offers two main pricing plans:

- Starter: Starting at $19 monthly, this plan is designed for new businesses and marketplace sellers. It includes 200 monthly orders, up to 3 data import integrations, and email support.

- Professional: Starting at $99 per month, this plan is ideal for most small-to-mid-sized businesses with a need for real-time calculations and multi-state reporting and filing. It includes 200 monthly orders, up to 10 total integrations, historical sales tax data archive, and more.

3. Avalara

Avalara is a robust and scalable tax compliance solution that automates the complexities of calculating, collecting, reporting, and remitting taxes. It is designed to serve businesses of all sizes, from small startups to large enterprises.

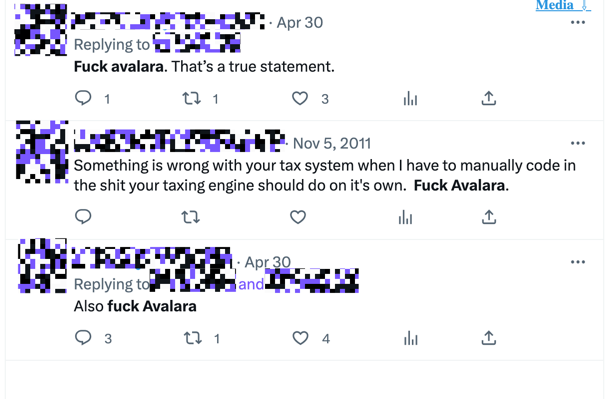

However, folks who use it don’t like it very much:

- Hidden costs

- Terrible customer service

- Locks you in for 1/2/3 year contracts

Don’t believe me? These are the stuff you see on Twitter.

Key Features

- Automated tax calculations: Avalara provides real-time tax calculations using geolocation to deliver the right rate every time a customer checks out. A user praises this feature for its accuracy and efficiency.

- Tax return preparation and filing: It prepares and files your sales tax returns and remits payments across multiple jurisdictions on your behalf. A user has highlighted this feature for its effectiveness in dealing with complex tax issues.

- Exemption certificate management: It allows you to manage exemption certificates in one place, reducing the audit risk.

- Global tax compliance: Avalara supports tax calculations in more than 200 countries, making it a great choice for businesses with a global customer base.

- Integrations: It integrates with hundreds of ERP, ecommerce, mobile payment, and point-of-sale systems, which makes it easy to implement and use.

Pricing

Avalara’s pricing can go anywhere from $12k per year to upwards of $50k/year with 1/2/3 year contracts.

4. TaxCloud

TaxCloud is a cloud-based sales tax management service designed for online retailers. It offers automatic sales tax calculation for any address in the United States and automatic filing and remittance in states where you’ve chosen to use TaxCloud as your CSP (Certified Service Provider).

Key Features

- Automatic sales tax calculation: TaxCloud calculates sales tax in real-time for any address in the U.S. This feature is particularly useful for businesses with customers across different states, as it ensures the correct sales tax rate is applied based on the customer’s location.

- Seamless integration: TaxCloud can be easily integrated with various ecommerce platforms, making it a convenient solution for online retailers. Users have reported that the integration process is straightforward, even for those with limited technical skills.

- Automatic filing and remittance: With this tool, you can automate your sales tax filing and remittance in states where you’ve chosen to use TaxCloud as your CSP. This feature can save you considerable time and effort, as you won’t have to file and remit sales tax returns in those states manually.

- Affordable pricing: It offers a cost-effective solution for sales tax management. Users have noted that while the cost per transaction can be a bit high for small to medium-sized businesses, the overall value TaxCloud provides makes it a worthwhile investment.

Pricing

TaxCloud operates on a pay-as-you-go pricing model, which means you only pay for the services you use. For more detailed information, you can check their pricing page.

5. Vertex

Vertex is a trusted provider of comprehensive, integrated tax technology solutions. It empowers companies of all sizes to do business anywhere, anytime, without friction. With Vertex, you can seamlessly integrate tax SaaS solutions that support your growth, whether you are local or going global.

Key Features

- Tax compliance solutions: Vertex offers tax compliance solutions that allow businesses to operate without friction. It provides a seamless experience, enabling companies to conduct business anywhere. A user mentioned that Vertex is a robust and reliable solution for managing sales and use tax.

- Integration with business systems: It integrates with various business systems, providing a unified platform for managing all your tax-related tasks. This integration allows for a streamlined workflow, reducing the time and effort required to manage taxes. A user liked the software’s ability to handle complex tax scenarios and seamlessly integrate with their ERP system.

- Support for growth: Whether you’re a local business or going global, Vertex provides solutions that support your growth. It offers scalable solutions that can adapt to your business’s changing needs. Another user praised Vertex for its comprehensive tax content and the ability to customize taxability rules.

Pricing

The pricing for Vertex isn’t publicly available. You need to set up a demo to get the pricing details.

Factors to consider when choosing a sales tax software

When choosing a sales tax software for your ecommerce business, there are several factors you should consider to ensure you select the best tool for your needs.

Here are some key factors to consider.

1. Core functionality

The core functionality of sales tax software should be its ability to accurately calculate, collect, and remit sales tax for each transaction. The software should be able to handle the complexity of transactional tax compliance, including sales and use tax, VAT, and GST. It should keep up with constant jurisdictional rate changes and taxability. The software should also be able to handle the tax implications of every invoice and ensure that the tax calculations are correct.

2. Features

Key features in sales tax software include real-time tax calculations, automated remittance, and the ability to aggregate transactional data across all channels, including marketplaces.

The software should also be able to adapt to changes in your business and sales tax obligations. Other important features include reporting capabilities, security certifications, and the ability to integrate with existing ERP and e-commerce platforms.

3. Usability

The usability of the sales tax software is critical. The software should be easy to use and should not require extensive training. It should have a user-friendly interface and should be easy to navigate. The software should also be flexible and adaptable to the specific needs of your business.

4. Software integrations

The sales tax software should be able to integrate with your business’s Enterprise Resource Planning (ERP) system.

This allows for regulatory updates, jurisdictional changes, and other tax policy data to be added to the system and applied throughout your organization from a centralized, cloud-based hub. The software should also be able to integrate with other systems and IT infrastructures in your business.

5. Value for price

The cost of the sales tax software should provide value for the price. The software should be cost-effective and should not require a large upfront investment. The cost of the software should also include updates and support from the vendor.

It’s estimated that every dollar in tax errors costs an average of thirty-three dollars to resolve, so getting taxes right the first time with reliable software is critical.

Our pick: Numeral

Choosing the right sales tax software can save ecommerce businesses thousands of dollars a year. These tools can handle complex sales tax calculations, remittances, and compliance issues efficiently and effectively. Numeral, TaxJar, Avalara, TaxCloud, and Vertex are top-rated sales tax software that can automate your sales tax management.

Numeral is one of the most comprehensive and user-friendly solutions that simplifies sales tax from registration to remittance.

Its ability to automatically monitor your store settings for proper sales data collection, handle registrations in all states it has nexus in, and manage automated remittances ensures that businesses remain compliant with all tax obligations.

Numeral also seamlessly integrates with various ecommerce platforms, providing a streamlined workflow. With excellent 24/7 customer support, access to a registered Certified Public Accountant, strategic tax advice, and communication management with state agencies, Numeral offers unmatched value to its users.

The transparent pricing structure of the software is another significant advantage compared to its counterparts.